28+ ratio of income to mortgage

Ad 5 Best House Loan Lenders Compared Reviewed. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances.

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

For example if you have 1000 of monthly debt and make 3500 a month then your debt-to-income ratio would.

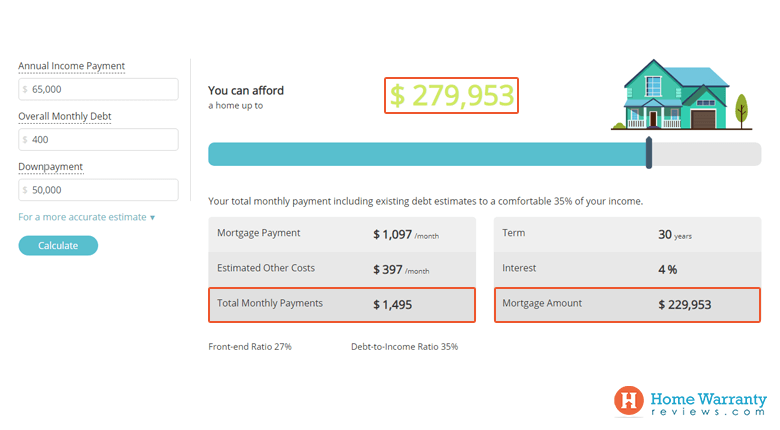

. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. It takes 41 of the median Colorado income to make the monthly mortgage on the median-priced home. Web Debt-to-income DTI ratio When applying for a mortgage.

News Feb 23 2023 0444 PM MST. Ad Learn More About Mortgage Preapproval. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

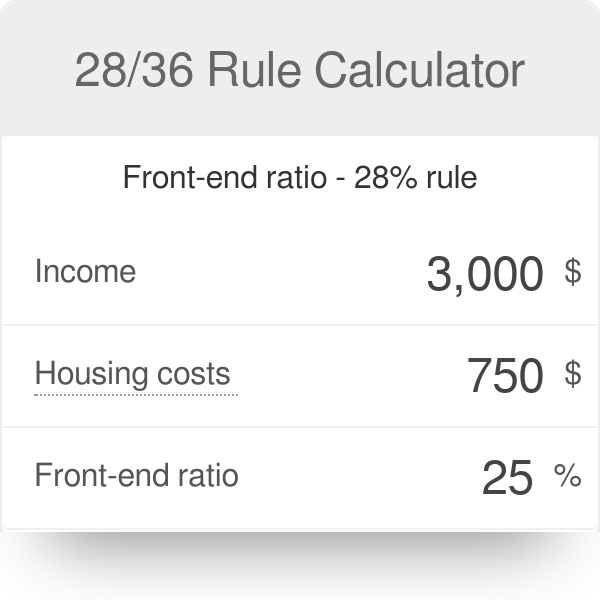

Web The Standard Mortgage to Income Ratio Rules. Web When considering a mortgage make sure your. Web The 2836 is based on two calculations.

Looking For a House Loan. All loan programs have their own maximum debt ratio allowances as follows. In that case NerdWallet recommends an annual pretax income of at least 184656.

Lock Your Mortgage Rate Today. Browse Information at NerdWallet. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

Web If the lender requires a debt-to-income ratio of 2836 then to qualify a borrower for a mortgage the lender would go through the following process to determine what expense. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Take Advantage And Lock In A Great Rate.

Your DTI or debt-to-income ratio is based on two numbers. Were not including any expenses in estimating the. Were Americas Largest Mortgage Lender.

Use NerdWallet Reviews To Research Lenders. This by income mortgage calculator will estimate what you can afford based on your salary. Web How to calculate debt-to-income ratio.

Take Advantage And Lock In A Great Rate. Compare Lenders And Find Out Which One Suits You Best. Receive 1000 Off On Pre-Approved Loans.

Principal interest taxes and insurance. Ad Compare Mortgage Options Calculate Payments. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Comparisons Trusted by 55000000. Web 6 hours agoIncome-to-mortgage ratio among US. Ad Learn More About Mortgage Preapproval.

Use NerdWallet Reviews To Research Lenders. Apply Now With Quicken Loans. Colorado has a higher-than-average median income but its still tough.

Web 7 hours agoHow Colorados income-to-mortgage ratio stacks up. Web The amount of money you spend upfront to purchase a home. Web Heres how the debt-to-income ratio is calculated.

Most home loans require a down payment of at least 3. In this formula total monthly debt. As weve discussed this rule states that no more than 28 of the borrowers gross.

A 20 down payment is ideal to lower your monthly. Browse Information at NerdWallet. Web Your front-end ratio is the percentage of your annual gross income that goes toward paying your mortgage and in general it should not exceed 28.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. A front-end and back-end ratio.

Your total debt divided by your gross monthly income. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web If youd put 10 down on a 555555 home your mortgage would be about 500000.

Ad Calculate Your Payment with 0 Down.

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

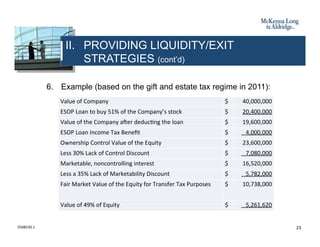

Business Succession Planning And Exit Strategies For The Closely Held

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

28 36 Rule Calculator

Mortgage Calculator Financial Philosophies

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Home Affordability Calculator

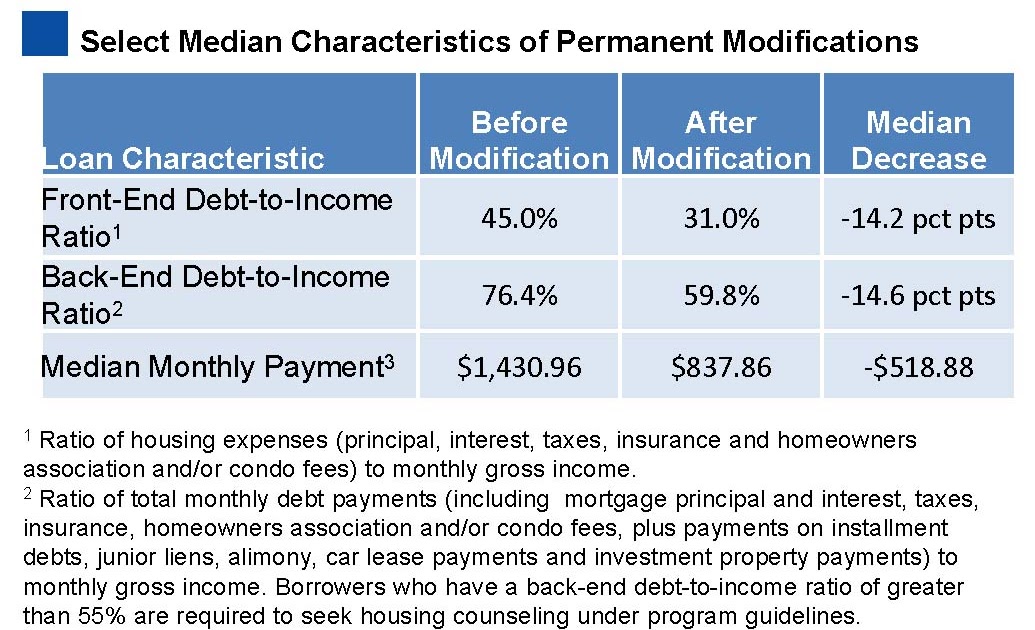

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

What Percentage Of Your Income Should Go To Mortgage Chase

Solved First Filling The Blank A Back End B Front End Chegg Com

What Is The 28 36 Rule Lexington Law

Income To Mortgage Ratio What Should Yours Be Moneyunder30 Mortgage Payment Mortgage Payoff Mortgage

Need A Mortgage Keep Debt Levels In Check The New York Times

Ex 99 1

How Much Of Monthly Income Should Go To Mortgage Budgeting Money The Nest